Henan Liyue New Energy Co., Ltd

How the U.S. IRA is Strengthening China’s Battery Dominance

The IRA’s Unintended Consequences: Strengthening China’s Battery Industry

When the U.S. government passed the Inflation Reduction Act (IRA) resolution in 2022, the U.S. government’s goal was simple: strengthen the U.S. domestic supply chain to make the United States a leader in electric vehicle (EV) batteries and suppress Chinese companies. The plan was to offer huge subsidies—$45 for every kilowatt-hour (kWh) of battery produced—to encourage companies to make batteries here instead of in China. But things didn’t go as planned. Instead of shutting out Chinese companies, the IRA is actually helping them get stronger. Here’s why.

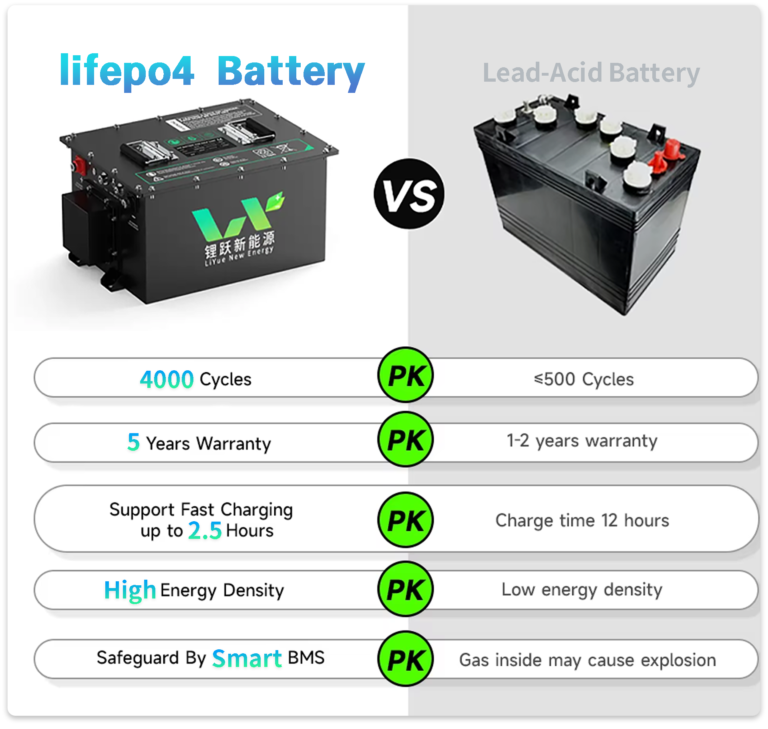

Let’s start with the subsidies. The idea was to make it cheaper for U.S. companies to make batteries so they can compete with China. But there’s a problem: Making batteries requires not only a lot of money, but also world-leading technology. Chinese companies like CATL and BYD have spent more than a decade perfecting their technology and investing in research and development, especially lithium iron phosphate (LFP) batteries, which are cheaper and safer than other types of batteries.

When Ford announced a $3.5 billion deal with CATL to build an LFP battery plant in Michigan, it showed how far behind American companies really are in technology. Instead of developing its own technology, Ford licensed CATL’s technology patents to produce batteries. Why? Because it’s faster and cheaper than starting from scratch. IRA subsidies make this partnership more attractive, but they don’t solve the most fundamental problem: American companies are actually more dependent on Chinese technology than we think!

Counterproductive tariffs

In order to protect American companies, the US government not only loses money to subsidize domestic companies, but also imposes tariffs on foreign companies! Batteries produced in China alone are subject to tariffs as high as 38.4%. But the tariffs have not hurt Chinese companies, but have forced them to be creative. For example, BYD is building a large battery plant in Mexico. Since Mexico is part of the USMCA trade agreement, batteries produced there can enter the US market tariff-free.

Another Chinese company, EVE Energy, is also expanding in Malaysia. Thanks to a trade agreement called RCEP, batteries produced in Malaysia enjoy a 10% tariff discount when shipped to the US. These moves show that Chinese companies have not only survived US trade barriers – they have accelerated their globalization and flourished around the world.

The Real Issue: Technology

The core of the problem is not money or tariffs – it’s technology. Chinese companies have a huge head start. They have spent years improving LFP batteries, making them cheaper and more efficient. Today, Chinese companies can produce batteries for $50/kWh, while American companies can only produce batteries for $120/kWh.

IRA subsidies may help narrow this gap, but they are only a temporary solution. Without serious investment in research and development, the United States will continue to fall behind. The CATL-Ford deal is just the beginning. As more American companies realize that they can’t compete alone, we may see more joint ventures with Chinese companies.

The unintended consequence of the IRA isn’t just pushing Chinese companies to set up shop in places like Mexico and Malaysia, the U.S. is actually helping Chinese companies build a more global battery supply chain. That may not be what lawmakers intended, but it’s good news for the planet and consumers. A more diverse supply chain means more stable prices and fewer shortages, and Chinese battery exports are growing fast—up 23% last year alone. China is still ahead despite tariffs and subsidies. The real competition isn’t who can build the most factories; it’s who can innovate the fastest. And right now, China is winning.